A letter of intent to donate is a document that announces a donor’s intention to contribute money, food, or property to a charitable organization or cause. The LOI informs the recipient (“donee”) of the proposed donation, its intended purpose, and any conditions the recipient must honor (e.g., name recognition) . Should the recipient accept the charitable contribution, the parties can move forward by signing a formal donation agreement.

When writing a donation letter of intent, donors should ensure that their letter has all the necessary information and clearly lays out the terms to the recipient.

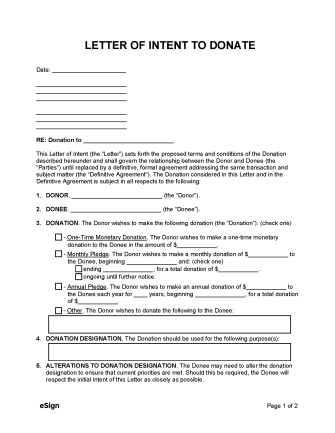

The letter of intent will need to provide the name, address, and contact information of the person submitting the donation (the donor) and the organization receiving the gift (the donee).

A donation letter of intent should explain the document’s purpose: setting the preliminary donation terms with the aim to make a legally binding agreement later on.

An LOI will include details about the gift, including the type of donation, payment instructions (for monetary donations), and an explanation of the donation’s intended purpose.

When donating money, the donor can provide additional details to describe whether the contribution is a one-time donation, monthly pledge, or annual pledge.

The donor should define an acceptance date in their letter of intent. Including this information guarantees that the recipient understands how long the offer is on the table. It also allows the recipient to prepare their organization and make arrangements for the upcoming contribution.

The donor must sign the LOI before sending it to the donee. The LOI should also include the donor’s printed name and the date their signature was written.

[DONOR NAME]

[DONOR STREET ADDRESS]

[DONOR CITY, STATE, ZIP]

[DONEE NAME]

[DONEE STREET ADDRESS]

[DONEE CITY, STATE, ZIP]

RE: Donation to [CHARITABLE ORGANIZATION]

This Letter of Intent (the “Letter”) sets forth the proposed terms and conditions of the Donation described hereunder and shall govern the relationship between the Donor and Donee (the “Parties”) until replaced by a definitive, formal agreement addressing the same transaction and subject matter (the “Definitive Agreement”). The Donation considered in this Letter and in the Definitive Agreement is subject in all respects to the following:

1. DONOR. Donor: [DONOR NAME] (the “Donor”).

2. DONEE. Donee: [DONEE NAME] (the “Donee”).

3. DONATION. The Donor wishes to make the following donation (the “Donation” ): [DESCRIBE DONATION] .

4. DONATION DESIGNATION. The Donation should be used for the following purpose(s): [DESCRIBE HOW DONATION SHOULD BE USED] .

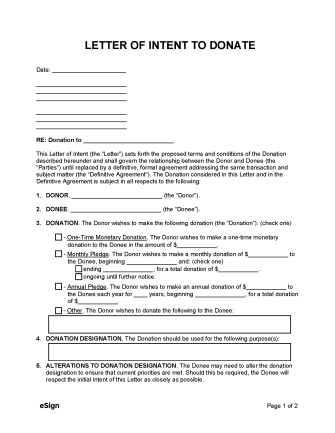

5. DONATION RECOGNITION. The Donor agrees to [WRITE “be recognized” or “remain anonymous”] for their charitable donation.

6. METHOD OF PAYMENT. If the Donation is monetary, payment shall be provided to the Donee as follows: [DESCRIBE METHOD OF PAYMENT FOR MONETARY DONATION] .

7. ORGANIZATION TYPE. The Donee is an organization that is [WRITE “classified” or “not classified”] as a 501(c)(3) non-profit organization by the standards of the Internal Revenue Service (IRS).

8. GOVERNING LAW. This Letter shall be governed under the laws in the State of [STATE NAME] .

9. ACCEPTANCE. If you are agreeable to the aforementioned terms, please sign and return a duplicate copy of this Letter by no later than [MM/DD/YYYY] .

10. INTENTION OF THE PARTIES. This Letter sets forth the intentions of the Parties to use reasonable efforts to negotiate, in good faith, a Definitive Agreement with respect to all matters herein. Notwithstanding paragraphs 9 through 13, which shall be legally binding, any legal obligations with respect to all other matters shall only arise if and when the Parties execute and deliver a Definitive Agreement.

11. SIGNATURES.

Donor’s Signature: ___________________ Date: [MM/DD/YYYY]

Print Name: [DONOR NAME]

Donee’s Signature: ___________________ Date: [MM/DD/YYYY]

Print Name: [DONEE NAME]

There are several reasons donors should use an LOI to relay their donation. Not only does the letter clarify where the gift is coming from, but it also provides instructions for the use of the contribution. Additionally, donors may find an LOI useful for the following reasons: